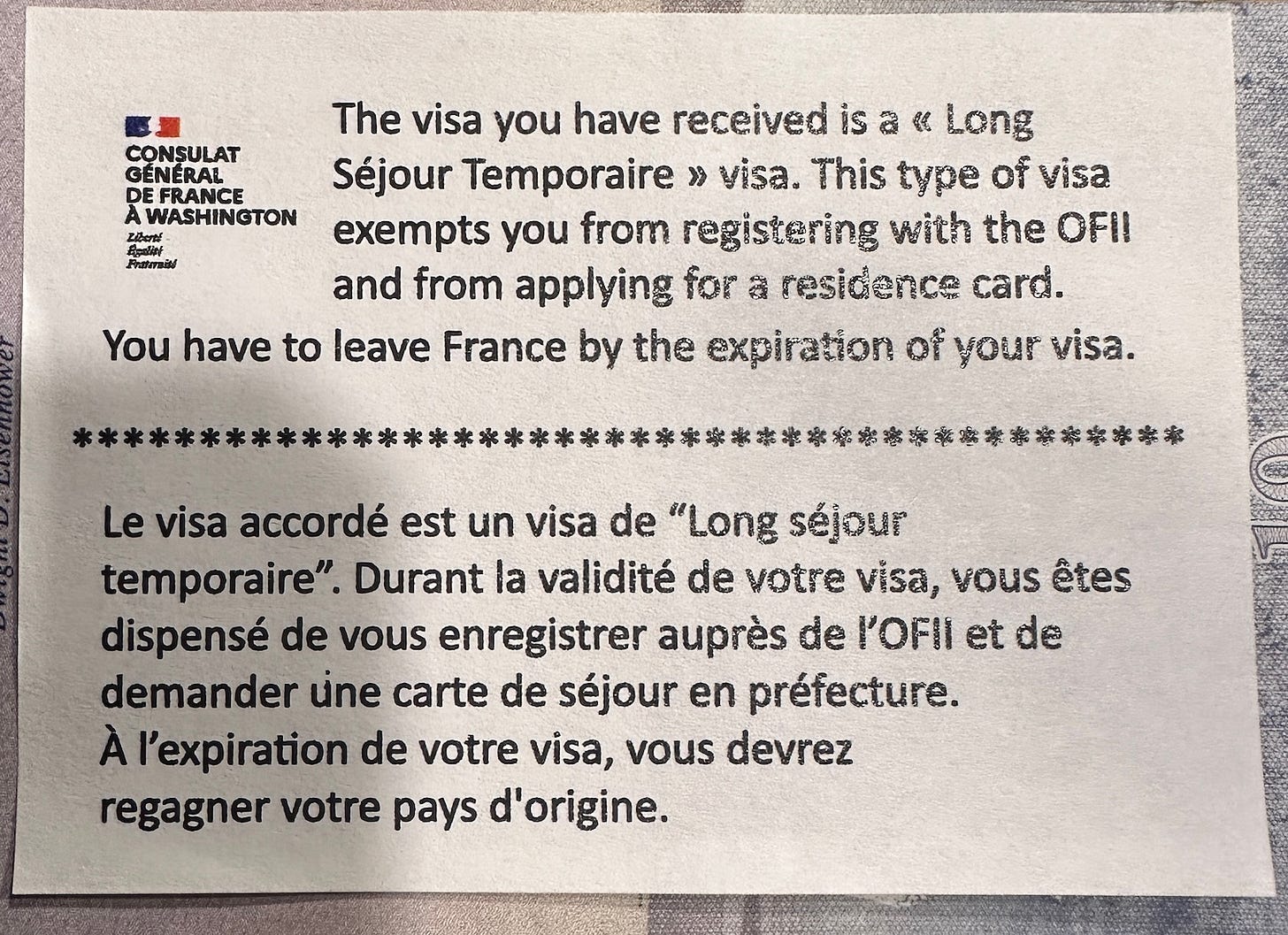

Carolyn and I will return to France in about five weeks. We got our French visas back quickly - I think it took about one working week for the French Consulate (with the help of FedEx) to return our passports with fresh new visas in them! This time, under “Remarks” the visas say LONG SEJOUR V2 VLST DISPENSE TS and the French Consulate had taped a notice into the passports:

Our previous visas said V1 VLSTS VALIDER EN LIGNE - we registered them with the OFII, bought a tax stamp at the corner tabac, and I had to go in for a medical exam (Carolyn didn’t get called for a medical exam). The medical exam was basic, a few questions about medical history, vaccines, and current medications along with the usual height, weight, and blood pressure. No needles. Needles don’t bother me - my point is that the exam wasn’t invasive. The staff at the health office was very friendly and their English was slightly better than my French so communication was easy.

The different visa type this time worries me. I want to be sure it still counts as part of the sequential process of becoming permanent residents. My understanding is that we must get one year visas for three years in a row, then we can ask for a five year visa, and after that we can apply for a ten year visa and permanent resident status. It has been hard to find a definitive answer to the difference between the V2 and V1 visas. Maybe V2 is just them counting the number of visas we have applied for (V1, V2, V3…) and we don’t have to register with OFII because we already did that last time. Or maybe it’s something else. I will keep investigating.

Taxes and Social Charges:

What will happen when we finally trigger the requirement to pay income tax in France? I have been panicking that there will one day be a knock on our door, “Madame/Monsieur, bonjour! Ze good news is you owe no income tax, ze bad news is that you must pay 90% tax on your existing assets, a check will be fine.”

Our tax consultant in the US explained that one’s primary tax liability is to whichever country you spend six months plus one day in, in other words - wherever you spend the majority of the calendar year is the primary place to pay your taxes. Don’t worry, there’s a tax treaty so you don’t get double taxed! Turns out it’s much more nuanced.

Disclaimer: Please keep in mind that the advice below was given to us for our specific situation and it is a lay-persons summary; you should consult your own tax attorney before making any moves!

Last week, we had a consultation with Me Berthier De Bortoli, a tax attorney who specializes in international and cross-border taxation through his firm VBDB Tax. (Me is an abbreviation for the French title Maître, which is used for lawyers, notaries, and judicial officers.) He explained that one might trigger the need to file income tax in France regardless of which country the majority of the calendar year is spent. One’s tax status comes down to whether the French tax authority can reasonably establish that you have made France your “center of vital interests.” They use a variety of metrics to make this determination, including:

Do you have a home in France? If not, you probably haven’t made France the center of your vital interests.

Do you have a home in either country that’s available to you? (If it is rented out long term, then it is not considered to be available to you while rented; if you are renting out your French home short term (e.g. AirBNB, VRBO) they may consider it as being available to you since you could stop the short term rentals at any point and use the dwelling yourself.

Where is the center of your personal and economic vital interests? For this determination, economic interests and personal interests are weighted equally. Do you belong to (say) a church, a gym? Do you belong to any clubs or professional organizations? The tax authority can use this information to make the case that France is the center of your personal vital interests.

Where is your habitual abode? For this they look at the frequency and length of stays in each country.

Unsurprisingly, you are better off submitting tax paperwork before the authorities come ask you to do so. If you wait, when the tax authority finally contacts you they’ll have several years of records and they could demand back taxes, late fees, penalties, and possibly even jail time! You’ll be on the defensive.

The attorney explained that the tax treaty between France and the US is very beneficial to US citizens. There’s no French income tax on US-based retirement income, royalties, bond interest, or rental income (below a certain threshold). There is also no wealth tax on Americans for the first five years (I am not sure if the five year timeline starts from the date of our first visa or from the date we are determined to be responsible for filing French income taxes). After the five year period there is a range of brackets for the wealth tax with rates ranging from 0.5% -1.5% of worldwide assets; for now there is no wealth tax on US cash and stock assets.

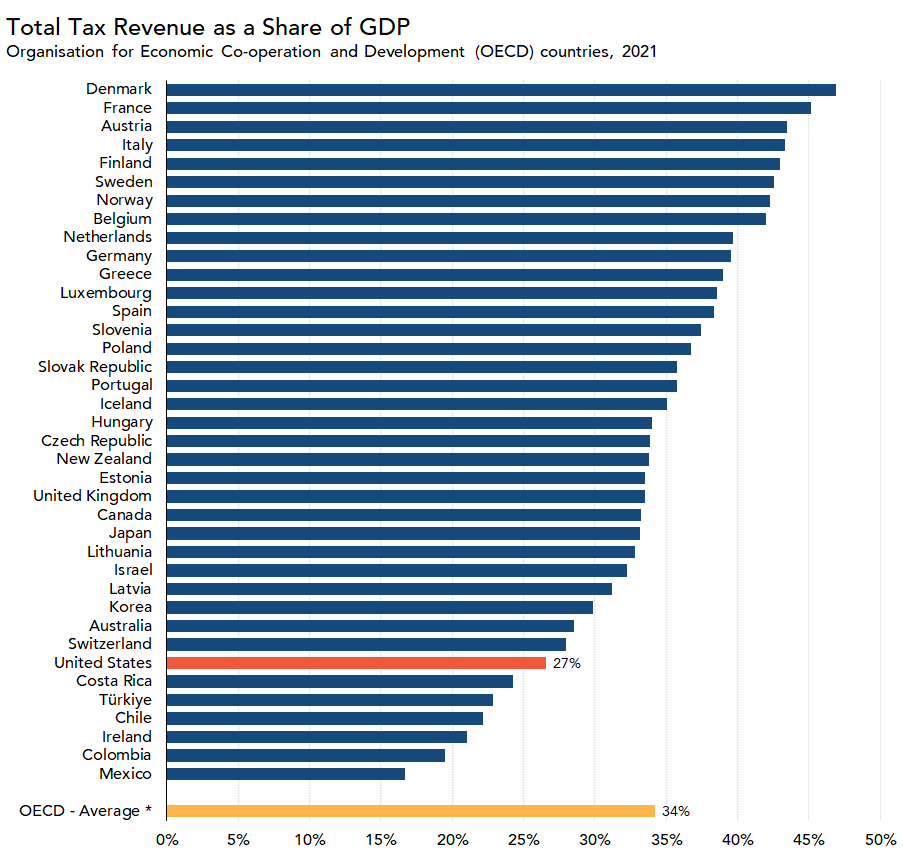

Taxes in France are much higher than in the US. France has a progressive income tax structure, the highest tax bracket is around 45% plus social charges and applies to households with taxable income over €180,000. In addition to income tax the Social Charges range from 13-40% of taxable income. Social Charges cover the costs of health care, unemployment, retirement and other social welfare programs. Payments for social charges are deductible from income tax, giving tax payers some relief.

By no means do I feel I have a clear picture of everything we should expect moving forward. But I feel more educated and confident after speaking with the tax attorney. I’m sure there will be surprises, but so far nothing seems outrageous and I feel confident there won’t be any huge tax bills landing in our lap. I also feel good about our team of attorneys and consultants in both countries; I’m sure they’ll help us navigate the systems. We want to support the French economy and social programs and we have no objection to paying our fair share as we continue building our life in Montpellier.

Jusqu’à la prochaine fois,

Roberto & Carolyn

The Danes pay the highest taxes, but repeatedly vote to keep things that way and they repeatedly are listed at the top of the "happiest" list! One Dane cheerfully told me that they pay for three cars, and then the government lets them keep one of them! No medical or school bills for anyone.

The VLs-T (temporaire) is NOT the right visa if you want to stay. You need to leave at the end and it is NOT reneeable.